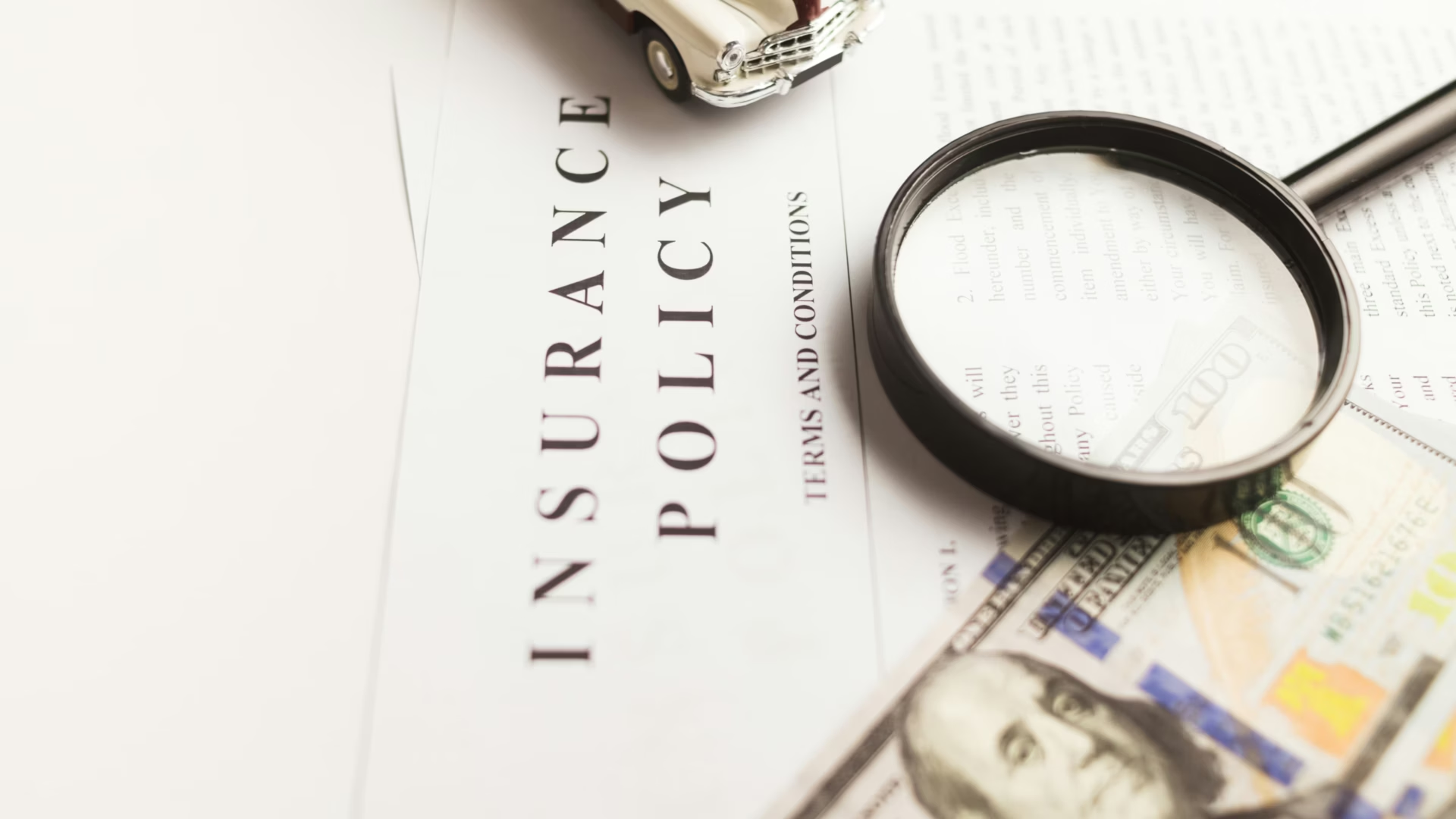

Few challenges are disrupting real estate transactions more unpredictably than the recent surge in insurance premiums. From first-time buyers to seasoned investors, clients across the country are seeing higher-than-expected costs that can delay deals, derail financing, or cause buyers to walk away. For real estate professionals, understanding why premiums are climbing and how to guide clients through these challenges is due diligence and a critical service.

Here, we explore the reasons behind rising insurance premiums, how these changes affect real estate transactions, and actionable steps agents can take to support their clients. With economic shifts, climate change, and evolving risk models all contributing to this trend, now is the time for real estate professionals to respond with expertise, communication, and strategic marketing support.

Find It Fast

Why insurance premiums are on the rise

There are several contributing factors behind the sharp increase in property insurance premiums, many of which converge at the intersection of climate, policy, and market dynamics:

- Climate-related disasters

Wildfires, hurricanes, floods, and other extreme weather events are becoming more frequent and destructive. Insurers are recalibrating risk models, leading to higher premiums in areas previously considered low-risk. In California, Florida, Texas, and other high-exposure markets, annual premiums have doubled or even tripled for many homeowners. - Rising construction and repair costs

Material and labor shortages have driven up the cost of rebuilding homes. Insurers must account for higher replacement costs, leading to steeper premiums across the board; even in regions not prone to natural disasters. - Carrier withdrawals and reduced underwriting

Several insurance carriers have pulled out of high-risk regions entirely or significantly reduced their exposure. This limits consumer choice and puts upward pressure on premiums from the remaining carriers, who take on more risk and pass along the cost. - Reinsurance volatility

Reinsurance, the insurance purchased by insurers, has also become more expensive and harder to obtain. That cost trickles down to consumers, particularly in states with heightened exposure to catastrophic losses.

How insurance issues disrupt real estate transactions

These rising premiums are line-item headaches, but they can also affect the entire transaction timeline and feasibility.

- Deal delays and fall-throughs

Clients facing unexpectedly high insurance quotes may not qualify for financing. Lenders often factor insurance into debt-to-income ratios. A spike in premiums can suddenly disqualify a previously approved borrower. - Appraisal and valuation gaps

Higher insurance requirements may push total monthly housing costs beyond what an appraiser deems reasonable. That can lead to lender denials, buyers renegotiating their offers, or abandoning the purchase altogether. - Reduced buyer pool in high-risk areas

Premium increases affect buyer psychology and budget. Even in desirable markets, properties in flood zones or fire-prone areas may receive fewer offers, longer days on market, or require significant pricing concessions. - Loss of confidence

When buyers feel blindsided by insurance surprises late in the transaction process, trust can erode, both in the deal and in the professionals advising them.

What agents can do to support their clients

Despite the challenges, this is where skilled real estate professionals shine. Agents can play a powerful role in reducing friction, restoring confidence, and helping clients make informed decisions throughout the process.

While it’s not the agent’s role to provide insurance advice, staying informed about general trends allows you to flag potential issues early and guide clients toward the appropriate experts when needed.

- Get ahead of the insurance conversation

Proactively address insurance costs in early conversations, especially in markets known for elevated premiums. Recommend that clients speak with a trusted insurance agent early in their home search, not after they go under contract. - Build a vetted insurance partner network

Just as you recommend lenders and inspectors, add experienced insurance professionals to your referral list. Seek out brokers with strong access to multiple carriers who understand your local market’s risks. - Highlight property risk-reduction features

Fire-resistant materials, new roofs, updated electrical systems, and mitigated landscaping can all reduce premiums. In listing descriptions and showings, highlight these features and their financial implications. - Guide clients through premium expectations

Use comps and historical context to help clients understand what’s typical for a given area. While you’re not an insurance agent, being informed on general trends will help your clients make faster, smarter choices. - Offer marketing support for sellers facing pushback

If rising premiums reduce the buyer pool or impact pricing, your ability to strategically market a property becomes even more important. This is where agents powered by Luxury Presence stand out: Our data-driven marketing tools, elegant web design, and SEO-backed lead generation help properties shine even in slower markets.

Why this matters right now

According to Luxury Presence’s 2024 State of Real Estate Marketing report, 23.8% of agents expect a seller’s market, but 20.1% also anticipate that fewer buyers will seek agent representation due to affordability issues. As premiums rise and affordability tightens, buyers are making more self-directed decisions and agents must deliver tangible value at every stage of the process.

In addition, more agents are investing in business infrastructure to weather the storm: In 2024, 60% of high-GCI agents increased their marketing budgets, focusing on digital tools, social content, and personal brand development. This signals a shift in how agents compete: by becoming better advisors, not just transaction facilitators.

Your brand starts here

Use this companion to Josh Flagg’s masterclass to elevate your marketing and sharpen your online presence.

Stay competitive with Luxury Presence

At Luxury Presence, we empower agents to rise above market noise with best-in-class marketing solutions, elite branding support, and lead generation tools that drive real business results. Our clients close more deals, win more listings, and serve more discerning clients because they show up with the right tools and insights every time.

If you’re ready to elevate your presence, streamline your business, and win in today’s complex market, connect with our team today for a strategy session tailored to your goals.

Get the platform that drives results.

Agents using Luxury Presence grew sales nearly 2x faster than their peers, increased sold listings by 6%, and closed over $300B in transactions. Ready to grow your business? Let us show you how.