New real estate agents face both upfront costs and recurring monthly expenses as they build their business. Understanding these expenses early helps you plan your budget, avoid surprises, and make smarter decisions in your first year.

Find It Fast

Licensing and professional fees

When becoming a real estate agent, these expenses get you licensed, keep you compliant, and give you access to the tools you need to work with clients, including the MLS and required associations. Most agents pay these costs before earning their first commission.

Pre-licensing course

Cost: $250 to $700 (one time)

Is This Tax-Deductible?: No, because this training is required before your business is active.

Money-Saving Tip: Online state-approved courses are usually the most affordable. Choose a self-paced option so you can study on your schedule without paying for extra classroom time.

Common Mistake: Paying for premium bundles that add extras like live tutoring, bonus exam drills, or printed textbooks you will not use. Choose the standard package unless you know you need the additional support.

Exam practice materials

Cost: $20 to $150 (one time)

Is This Tax-Deductible?: Not usually, since they are part of obtaining your license.

Money-Saving Tip: One solid practice test book or digital bundle is enough for most people. Pick a resource with full-length exams so you know exactly what to expect.

Common Mistake: Buying multiple overlapping study programs. Find one comprehensive prep book.

State exam fee

Cost: $40 to $100 (one time, per attempt)

Is This Tax-Deductible?: No, state exam fees are not deductible.

Money-Saving Tip: Schedule your exam on a day when you have no work, childcare, or personal conflicts so you do not risk missing it. Most testing centers charge a rescheduling fee if you cancel late or do not show up.

Common Mistake: Forgetting required documents such as your government ID, confirmation email, or authorization-to-test letter. Create a simple exam-day checklist so you do not have to reschedule and pay extra fees.

Background check

Cost: $30 to $75 (one time)

Is This Tax-Deductible?: No, background checks for licensing are not deductible.

Money-Saving Tip: Use the fingerprinting vendor your state recommends. Approved providers almost always cost less and process results faster.

Common Mistake: Waiting too long and delaying license activation. If fingerprinting is required, schedule early so processing times do not push back your start date.

License application fee

Cost: $50 to $150 (one time)

Is This Tax-Deductible?: No, because it is required before you begin earning income.

Money-Saving Tip: Apply online instead of mailing paperwork. It saves time, reduces errors, and avoids any extra mailing or processing fees.

Common Mistake: Entering incorrect information and needing to refile. Double-check every field before submitting to avoid delays and added costs.

License renewal

Cost: $50 to $200 (annually)

Is This Tax-Deductible?: Yes, renewals are deductible once you are an active agent.

Money-Saving Tip: Set digital reminders 30 and 60 days before your renewal date. Early renewal avoids late penalties and keeps your license active without gaps.

Common Mistake: Missing renewal reminders and paying late fees. Add renewal dates to your digital calendar with automated alerts.

MLS access

Cost: $300 to $600 (annually)

Is This Tax-Deductible?: Yes, MLS fees are deductible business expenses.

Money-Saving Tip: Ask your brokerage whether your MLS fees are already included in your onboarding package. If not, pay annually for the lowest rate.

Common Mistake: Paying for MLS access when your brokerage or team already covers it. Always ask during onboarding so you do not duplicate fees.

REALTOR® Association dues

Cost: $150 to $650 (annually)

Is This Tax-Deductible?: Yes, association dues are deductible.

Money-Saving Tip: Set aside a small amount each month so the annual dues do not feel like a surprise bill. Review optional add-ons and skip anything you will not use.

Common Mistake: Forgetting to budget for yearly billing cycles. Set aside a monthly amount so the annual payment does not surprise you.

Total cost for licensing and professional fees

Licensing and professional fees typically range from about $900 to $2,600 in your first year. This total reflects one-time startup costs plus required annual dues and MLS access. Most of these expenses decrease after your first year, leaving only renewals and MLS moving forward.

Let’s chat

Choosing your website provider is a big decision, and you probably have questions.

Brokerage fees (non-transactional)

These are fixed costs you pay to your brokerage regardless of whether you close a transaction. They affect your overhead and monthly budget, not your per-deal take-home pay.

Brokerage startup fee

Cost: $0 to $500 (one-time)

Is This Tax-Deductible?: Yes, startup fees are deductible business expenses.

Money-Saving Tip: Ask if the brokerage waives this fee during recruiting periods or for new agents completing onboarding quickly.

Common Mistake: Paying without confirming what training, technology, and support are included.

Monthly brokerage fee

Cost: $50 to $200 per month

Is This Tax-Deductible?: Yes

Money-Saving Tip: Avoid paying for bundled software you already use elsewhere.

Common Mistake: Forgetting to annualize this cost when budgeting.

Desk fee

Cost: $0 to $500 per month

Is This Tax-Deductible?: Yes

Money-Saving Tip: If you work remotely, choose a virtual or flex plan.

Common Mistake: Paying for office space you rarely use.

Errors and omissions insurance

Cost: $30 to $70 per month

Is This Tax-Deductible?: Yes

Money-Saving Tip: Ask if group pricing is available through your brokerage.

Common Mistake: Assuming all policies provide the same coverage limits.

Commission cap charges

A commission cap is the maximum total amount of commission you pay to your brokerage in a year before your split improves. Once you hit the cap, you often keep 100 percent of your commission minus transaction fees.

Cost: Varies by brokerage and split structure (annual limit)

Is This Tax-Deductible?: Yes

Money-Saving Tip: Track your progress monthly so you know when your earnings improve.

Common Mistake: Not confirming whether fees fully stop after the cap is reached.

Total non-transactional brokerage costs

For most new agents, non-transactional brokerage costs typically range from about $1,000 to $10,000 per year, based on one-time startup fees, monthly brokerage fees, desk fees, and errors and omissions insurance. These costs apply whether or not you close any deals and represent your fixed annual overhead.

Transactional brokerage fees

These costs only apply when you close deals. They sit on top of your commission split and any cap structure and directly reduce your net commission.

Per-transaction fee

Cost: $200 to $800 (per transaction)

Is This Tax-Deductible?: Yes

Money-Saving Tip: Many brokerages reduce this fee after consistent production.

Common Mistake: Forgetting to subtract this from your net commission projections.

Transaction coordination or compliance fee

Some brokerages or independent coordinators charge an additional file management and compliance fee.

Cost: $200 to $500 (per closed transaction)

Is This Tax-Deductible?: Yes

Money-Saving Tip: Strong coordination can save hours per deal and reduce errors.

Common Mistake: Treating this as optional while still spending personal time on paperwork.

Total transactional brokerage costs

For an agent who closes 6 to 12 transactions per year, brokerage transaction-based costs typically range from about $1,200 per year on the low end to about $15,600 per year on the high end, based on combined per-transaction and coordination fees.

Marketing and advertising expenses

This category covers the real estate marketing materials and advertising tools that help you attract clients and grow your business. Marketing and advertising costs vary widely because agents choose different strategies based on budget and market.

AI marketing tools

Cost: $20 to $250 per month

Is This Tax-Deductible?: Yes, AI marketing tools for real estate are deductible software services.

Money-Saving Tip: Start with one tool that solves your biggest bottleneck. When that tool measurably improves your workflow, add others slowly so you never pay for unused software.

Common Mistake: Paying for several AI platforms without a clear strategy often leads to wasted spend. Many agents streamline their workflow with AI-driven marketing automation tools from Luxury Presence, though they come at a higher cost since they’re packaged with their award-winning website design platform.

Yard signs

Cost: $50 to $150 per sign

Is This Tax-Deductible?: Yes, yard signs used for listings are deductible.

Money-Saving Tip: Order signs and riders together to save on printing and shipping. Bundles are usually much cheaper than buying one-off pieces.

Common Mistake: Forgetting to budget for small add-ons like “For Sale” toppers or directional arrows and for replacing damaged signs.

Lockbox

Cost: $30 to $40 per listing

Is This Tax-Deductible?: Yes, lockboxes are deductible listing tools.

Money-Saving Tip: Buy a gently used lockbox from another agent or your brokerage. Many agents upgrade their equipment often, and used boxes work just as well.

Common Mistake: Buying a lockbox that uses a different app or key system than the one your local MLS and showing service use, which means other agents cannot easily access the property. Ask your broker or MLS which lockbox brand and app are standard in your area before you buy so every visiting agent can get in without issues.

Business cards

Cost: $25 to $75 per batch

Is This Tax-Deductible?: Yes, business cards qualify as deductible marketing materials.

Money-Saving Tip: Use standard finishes instead of premium upgrades.

Common Mistake: Ordering too many cards before finalizing branding.

Photography and videography

Cost: $150 to $1,000 per listing

Is This Tax-Deductible?: Yes, listing photography and video are deductible.

Money-Saving Tip: Ask real estate photographers about multi-listing packages or loyalty rates. Consistent work often earns discounts you will not get as a one-off client.

Common Mistake: Cutting corners on photos and video. Match the media package to the home’s price point and to what competing listings are doing.

Flyers, postcards, and print materials

Cost: $50 to $300 per batch

Is This Tax-Deductible?: Yes, printed marketing materials are deductible.

Money-Saving Tip: Use templates to avoid custom design fees.

Common Mistake: Printing far more flyers or postcards than you will realistically hand out. Start with smaller batches so you do not waste money on extras that sit in a box.

Social media ads

Cost: $100 to $1,000 per month

Is This Tax-Deductible?: Yes, social ad spending is deductible.

Money-Saving Tip: Start with small A/B tests before scaling campaigns.

Common Mistake: Boosting posts to “everyone” and hoping for the best. Always choose a specific audience so your money goes toward people who might actually become clients.

Google ads

Cost: $150 to $1,500 per month

Is This Tax-Deductible?: Yes, Google ads are fully deductible.

Money-Saving Tip: Focus on local, lower-competition keywords.

Common Mistake: Running ads on broad, high-cost keywords that drain your budget fast. Focus on specific local phrases that attract people who are actually looking to buy or sell.

Website hosting and domain

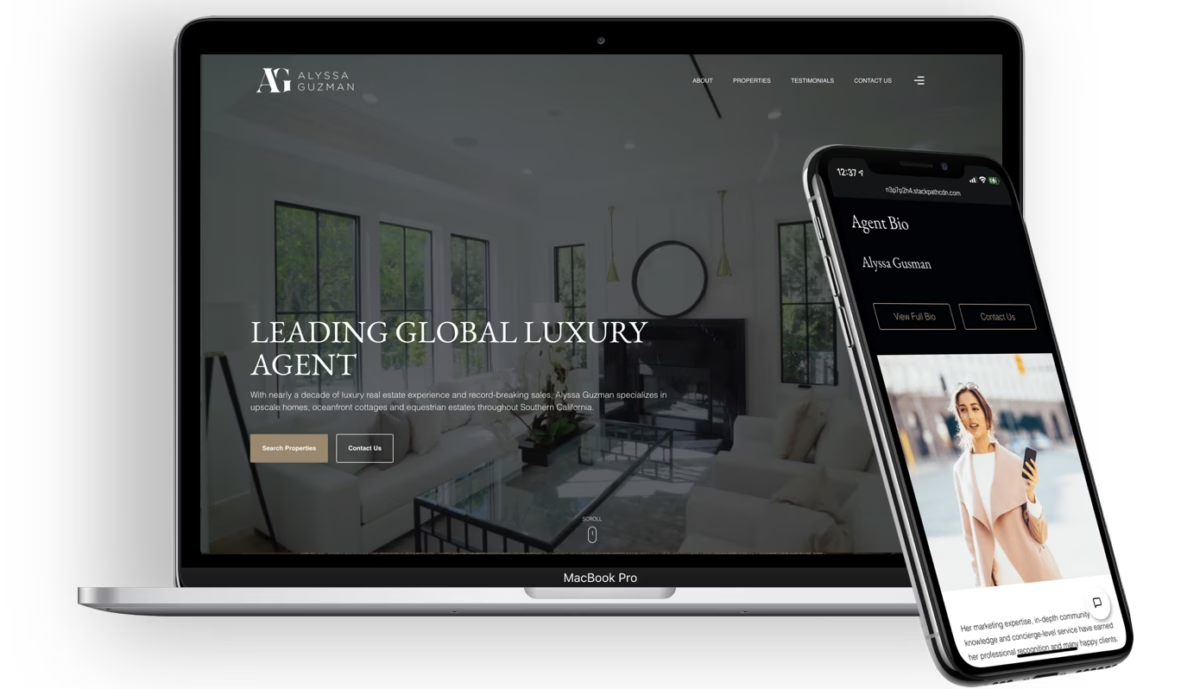

Cost: $20 to $50 per month for basic hosting, or $250 to $3,500 per month plus setup fees for a full-service platform like Luxury Presence.

Is This Tax-Deductible?: Yes, website costs are deductible.

Money-Saving Tip: Choose annual billing when possible if you are on a basic hosting plan.

Common Mistake: Comparing low-cost hosting to full-service platforms. Basic hosting only covers technical needs, while platforms like Luxury Presence include custom website design, AI marketing tools, AI lead nurturing, and lead capture features, which require a higher investment.

Total cost of marketing and advertising

Marketing and advertising typically range from about $300 to $3,000+ per month, depending on how aggressively you promote your business, how many listings you carry, and how much you spend on paid ads, photography, and premium website platforms. Agents running Google Ads, social ads, and high-end websites will land at the top of this range, while newer agents running lighter campaigns will stay closer to the low end.

Luxury Presence can elevate your marketing strategy

Learn how we can help take your real estate business to the next level. Schedule a time to speak with one of our branding experts today.

Technology and software

These tools help you stay organized, manage transactions, and deliver a smooth experience to clients. Most of these expenses renew monthly, and choosing the right stack keeps your workflow efficient.

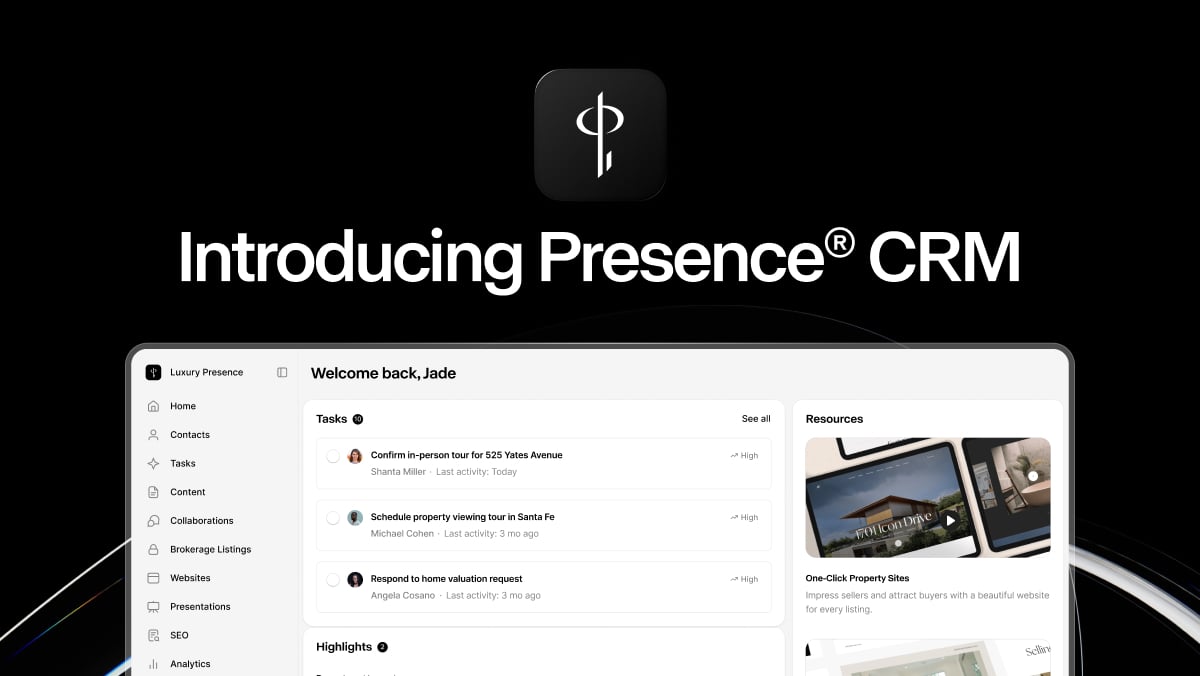

CRM software

Cost: $25 to $150 per month

Is This Tax-Deductible?: Yes, CRM subscriptions are deductible.

Money-Saving Tip: Begin with a starter plan until your database grows.

Common Mistake: Adding contacts without updating notes or follow-up tasks, which leads to missed opportunities and an unreliable database.

Email marketing tools

Cost: $15 to $100 per month

Is This Tax-Deductible?: Yes, real estate email marketing tools are deductible.

Money-Saving Tip: Use free tiers until your list expands.

Common Mistake: Sending the same email to every contact, even though buyers and sellers need different information. Create small segments, such as “new buyers,” “active sellers,” or “past clients,” so each group gets content that actually fits their situation.

AI lead nurturing

Cost: $20 to $200 per month

Is This Tax-Deductible?: Yes, AI client follow-up tools are deductible.

Money-Saving Tip: Choose tools that address slow response times.

Common Mistake: Relying on manual follow-up when automation would save time. Many agents rely on tools like Luxury Presence’s AI Lead Nurture Specialist, which sends instant, personalized SMS follow-ups until leads are ready to talk, though this tool only comes with their premium website platform and costs more than a standalone AI lead nurture tool.

Total cost of software and technology

Most agents spend $60 to $450 per month on software and technology, based on the combined cost of CRM, email marketing, and AI lead nurturing tools. Starting lean helps you avoid unnecessary subscriptions, and upgrading gradually ensures every tool supports your actual workflow.

AI Lead Nurturing Specialist

Automating personalized follow-ups: The right message at the right time so no opportunity slips through the cracks.

How real estate agents track their expenses

Real estate agents need simple, reliable systems to track hundreds of small business expenses throughout the year. The goal is to keep records organized so tax prep is easier and deductions are accurate.

Use one business account for all income and expenses

Keeping all commissions and expenses in one dedicated business account makes reporting and bookkeeping much simpler. It creates a clean separation between personal spending and business activity.

Options include:

- A dedicated business checking account at a major bank

- A business account at a local community bank or credit union

- A business credit card that provides clear monthly and annual statements

Track receipts and expenses digitally

Most agents rely on digital storage rather than paper. This makes receipts easy to find, categorize, and share with accountants during tax season.

Helpful Tools:

- Gmail Labels store emailed receipts in one searchable folder. Use labels such as Technology or License Renewal to stay organized.

- Google Drive keeps photos and files of receipts stored in organized cloud folders.

- Excel or Google Sheets allow simple expense tracking where you can categorize costs, total monthly spending, and flag items for potential tax deductions.

- QuickBooks Online automatically imports transactions and stores digital receipts.

- Expensify scans and categorizes receipt photos for clean, export-ready reports.

Use mileage apps for automatic trip tracking

Mileage is one of the largest deductions available to real estate agents. Automatic tracking ensures every business-related trip is captured accurately.

Helpful Tools:

- MileIQ tracks your drives automatically and lets you classify each trip with a simple swipe.

- Everlance tracks mileage and expenses together and generates IRS-compliant reports.

- Hurdlr automatically tracks mileage, income, and expenses for easy, tax-ready organization.

- Google Maps plus Excel offers a no-cost manual option using your route history.

Make your real estate budget work smarter with Luxury Presence

Luxury Presence helps agents maximize their marketing spend with high-converting websites, AI tools, and lead generation features built for growth. Click on the button below to book a demo.

Expert website design services

Every day, Luxury Presence creates and manages real estate websites for some of the biggest agents, teams, and brokerages in the country. Learn how we can transform your online presence.