Success in real estate isn’t just about charm, hustle or curb appeal — it’s also about the numbers. Behind every smart investment, accurate valuation and strategic decision is a solid grasp of math. Whether you’re prepping for your real estate exam, calculating mortgage payments, wholesaling, or flipping a property, understanding real estate math formulas gives you a critical edge.

These formulas aren’t just academic — they’re tools you’ll use daily to analyze deals, structure offers and guide clients with confidence. Read on for 12 essential real estate math formulas that every agent, investor and professional should know cold.

Find It Fast

Why it’s still essential to understand real estate math formulas

Even with the rise of automated tools, mobile apps, and AI-driven calculators, real estate professionals still benefit from understanding core real estate math formulas. These formulas — whether for calculating cap rate, loan-to-value ratio, or property tax estimates — remain the foundation for sound decision-making in every deal.

Applying real estate math formulas creates accuracy, confidence, and credibility. When you can run numbers on the spot, explain the math behind a valuation, or catch a potential error in an automated report, you position yourself as a knowledgeable, trustworthy advisor. Clients and colleagues recognize the value of a professional who understands not only what the numbers say but how they came to be.

Plus, not all situations allow for tech assistance. In fast-paced environments like property showings, client meetings, or initial consultations, you may not have time to open a calculator. Being fluent in real estate math formulas means you’re never caught off guard, even when tech isn’t on your side.

Ultimately, mastery of real estate math formulas strengthens your analysis skills, enhances your ability to spot opportunities or red flags, and deepens your overall financial literacy. It’s an essential skill set that supports long-term success in an ever-evolving industry.

1. Loan-to-value ratio

The loan-to-value ratio (LTV) is a measure used to compare the amount of your client’s mortgage to the value of the home they wish to purchase. Mortgage lenders often use LTV to determine their risk in extending credit to your client as a borrower.

Lenders favor a loan assessment with a low LTV because they see it as a lower risk. Contrarily, lenders see a high LTV loan assessment as a higher risk and may require your client to purchase mortgage insurance to offset that risk.

As a real estate agent, you commonly use this equation to help your clients.

Loan amount / Assessed value of the property = loan to value ratio

The LTV ratio is typically expressed as a percentage. For example, if the home value is appraised at $100,000 and your client’s mortgage lender offers them a loan for $80,000, then the LTV ratio for this house would be 80%.

2. The 28 / 36 rule (qualification ratio)

The 28/36 rule determines how much house your client may qualify for based on their income.

The 28 in this rule suggests the home buyer can qualify for 28% of their gross monthly income (before taxes). For example, if your client earns $12,000 monthly, they would qualify for a mortgage payment of $3,360.

On the other hand, the 36 in this home buyer rule considers your client’s additional debt payments (student loans, car loans, etc.). In this case, you would multiply their monthly earnings of $12,000 by 36% and get $4,320. Your client’s total debt payment and the mortgage must be below $4,320.

3. Down payments

Purchasing a property often requires your client to provide a down payment. You can help your client determine their down payment using the formula below.

Sale price x percentage payment = down payment amount

For example, if the house is worth $500,000 and the home buyer plans to provide the traditional 20% payment upfront, their total down payment amount will be $100,000.

4. Capitalization rate

The capitalization rate, or cap rate, measures a real estate investment property’s profitability. It helps investors figure out how much money they can make and keep cash flow positive while managing rental properties without taking on too much risk.

To calculate the capitalization rate, you’ll need to divide the property’s net operating income by its purchase price. The formula is as follows:

Net operating income / purchase price = capitalization rate

Let’s say, for example, you have a rental property that costs $800,000 and generates $80,000 in rent. It costs $20,000 to maintain it over the year. All costs considered, the cap rate would look something like this:

($80,000 – $20,000) / $800,000 = 7.5%

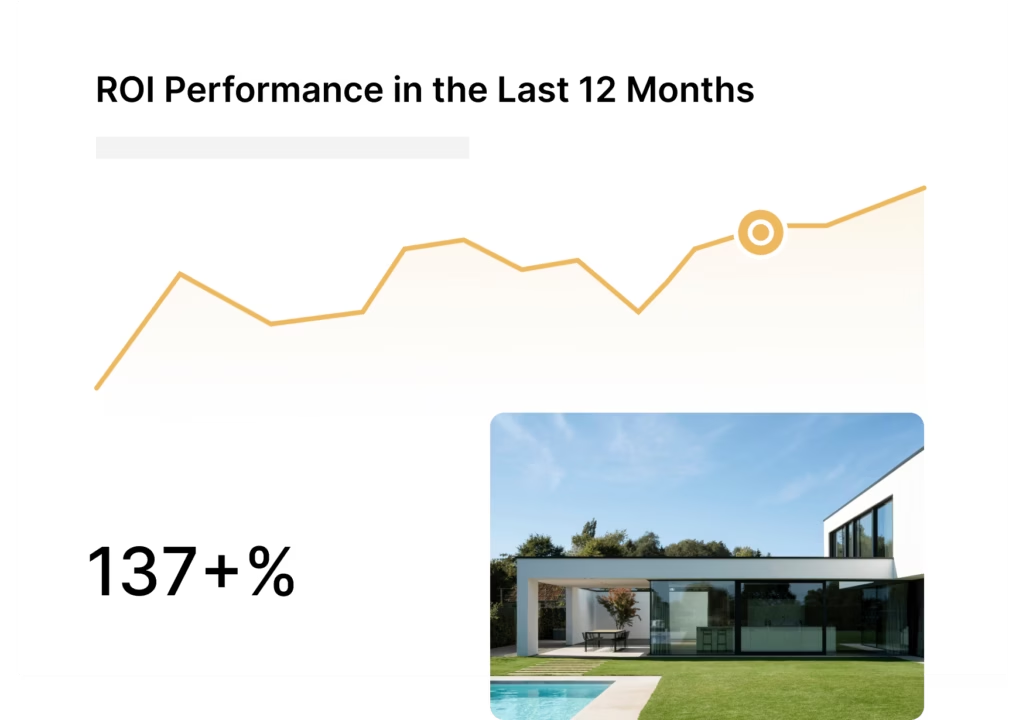

5. Return on investment (ROI)

ROI is a measure of how much is made on a real estate investment when it’s sold. You can calculate ROI using the below formula.

(Final value – initial cost) / cost = ROI

For instance, if you buy a property for $400,000 and sell it later for $450,000, the ROI would be:

($450,000-$400,000) / $400,000 = 12.5%

Perfect your budget

Curious about your return on investment when it comes to advertising? Our ROI calculator makes it easy to predict and optimize your campaign performance.

6. Prorated taxes

If you’re working with home buyers, they will typically pay a prorated tax amount at closing. To find this amount, you must first determine the amount of tax remaining on the property for the calendar year.

By identifying the number of days remaining in the year and dividing it by 365, you’ll get the percentage of the tax bill that your buyer will need to pay.

You can then multiply the above percentage by the amount remaining on the tax bill to get the final amount of property tax due at closing.

Suppose your client is closing on October 1st and the property’s annual tax bill is $4,000. With 92 days remaining in the year, dividing 92 by 365 gives approximately 0.252. Multiplying this by the tax bill results in a prorated tax amount of $1,008. This is the amount your client would need to pay at closing.

7. Calculations related to mortgage payments

Mortgage rate formulas help calculate the cost of borrowing over time, factoring in principal, interest rate, and loan term to determine monthly payments and overall affordability.

Principal and interest

The mortgage principal is the initial loan amount your home-buying client borrows from the bank to purchase a property.

For instance, if your client has $160,000 cash to make a 20% down payment on a house of $800,000. Then, the initial loan amount they need from the bank would be $640,000.

To determine the monthly interest rate, you’ll need to work with a mortgage lender to understand the annual interest rate for the mortgages in your area. Once you have the annual interest rate, you can divide the number by 12 to get a monthly rate.

So, if the annual rate is 3%, the monthly interest rate will be 0.25%.

Monthly mortgage payment

Use the formula below to determine how much your home-buying client will pay monthly on their mortgage. You can also use a free mortgage calculator to get this information.

Monthly Mortgage Payment Formula:

P [ i(1 + i)^n ] / [ (1 + i)^n – 1] = M

M = monthly mortgage payment

P = loan amount

i = monthly interest rate

n = number of payments (assume 30-yr, fixed)

Using the above example, let’s say the annual interest rate is still 3%, the mortgage payment will be:

M = $640,000(.0025(1 + .0025)^360)/((1 + .0025)^360 – 1)

M = $2,698

Property taxes

You’ll also need to know how much a home buyer can expect their property taxes will be. The government charges them automatically, but it’s still important for buyers who understand this number because they may run into some unexpected costs down the road if those numbers change or go up unexpectedly. You can determine this using the formula below.

Assessed home value x local tax rate = annual property taxes

Consider this scenario: If a property has an assessed value of $350,000 and the local tax rate is 1.2%, you can calculate the annual property tax by multiplying these values:

$350,000 × 0.012 = $4,200

This means the homeowner can expect to pay $4,200 in property taxes each year. Buyers should also account for potential tax rate changes or reassessments that could impact this amount.

8. Price per square foot

Price per square foot helps you find the value of residential and commercial properties. To calculate this, take the property’s sales price and divide it by the square footage.

Sale price / square footage = price per square foot

For instance, if the home has 2,000 square feet and the sales price is $400,000, then the price per square foot would be $400,000 / 2000 = $200.

9. Price-to-rent ratio

The price-to-rent ratio can help your clients estimate whether it’s cheaper (or more expensive) to rent or own property in their area. You can use the following formula to calculate this ratio.

Median home price / median annual Rent = price to rent ratio

Suppose your client is exploring housing options. They find a property with a median home price of $450,000, and the median annual rent is $30,000. Using the formula:

$450,000 ÷ $30,000 = 15

In this case, the price-to-rent ratio is 15. Generally, a ratio under 15 suggests it’s more affordable to buy, while a ratio above 20 may indicate that renting is the better financial choice.

10. Gross rent multiplier

Calculating the gross rent multiplier (GRM) will help determine a property’s value. You’ll need the annual rental income and property purchase price to get this information.

Purchase price or value / gross rental income = gross rent multiplier

For instance, if the property’s value is $200,000 and the annual rent income is $24,000, then the GRM for the property would be:

GRM = 200,000 / 24,000 = 8.3

Compare it to the other properties in the area to see if the purchase is fair. A lower GRM generally indicates that the property is undervalued.

11. Commission formula

As a real estate agent, the commission formula helps determine your commission and other professionals involved in the deal.

Commission Calculation formula:

Selling price × commission rate = commission

Let’s say you’re closing a property sale. The home sells for $500,000, and the agreed commission rate is 5%. Using the formula:

$500,000 × 0.05 = $25,000

Following this example, the total commission earned would be $25,000, which may be split among the agents involved based on their agreement.

12. 70% rule

The 70% rule helps you and your client determine whether or not they should invest in a property. Generally, a buyer should not invest in a property for more than 70% of the After Repair Value (ARV) minus any renovation costs.

70% rule formula:

(ARV) x .70 − estimated repair costs = maximum buying price

To illustrate, suppose a property’s ARV is estimated at $300,000, and the anticipated renovation costs are $40,000. Using the 70% rule, the maximum buying price should be calculated as follows:

($300,000 x 0.70) − $40,000 = $210,000 − $40,000 = $170,000

In this case, the buyer should aim to purchase the property for no more than $170,000 to ensure a profitable investment.

Work with us

While strong math skills are key, Luxury Presence empowers you with the tools and strategies to excel even further. To learn more about how to build your brand, close more deals, and expand your network, get in touch with us today!

Luxury Presence can elevate your marketing strategy

Learn how we can help take your real estate business to the next level. Schedule a time to speak with one of our branding experts today.